Sometimes it might seem like mortgage lenders and brokers speak a foreign language when you're trying to purchase a home. The annual percentage rate (APR) is a crucial subject to grasp before committing to a house loan and is likely to come up in your mortgage shopping. Everything you need to know is listed here. The interest rate charged or repaid yearly is the annual percentage rate (APR). The annual percentage rate (APR) is a metric used to illustrate the actual yearly cost of money throughout the life of a loan or investment. Expenses and charges related to the transaction are included here, but compounding is not. The APR is helpful because it gives a single metric that customers may use to evaluate various loan, credit card, and investment options.

Interest is a cost associated with using credit, including loans, credit cards, and other lines of credit. Calculate the annual percentage rate (APR) to see how much interest you'll pay on a loan or credit card over a year. APR and interest rates on credit cards are often exact. Other loans, such as mortgages that require you to pay closing fees, include those charges in your APR. However, annual and late payments on credit cards have no bearing on your annual percentage rate. Card issuers utilize APR to determine the interest rate applied to outstanding balances. Interest is often calculated daily by credit card companies. At the end of each day, your debt will be this much. The terms under which your loan or credit card interest rate may be changed are spelled out in your loan documents or cardholder agreement.

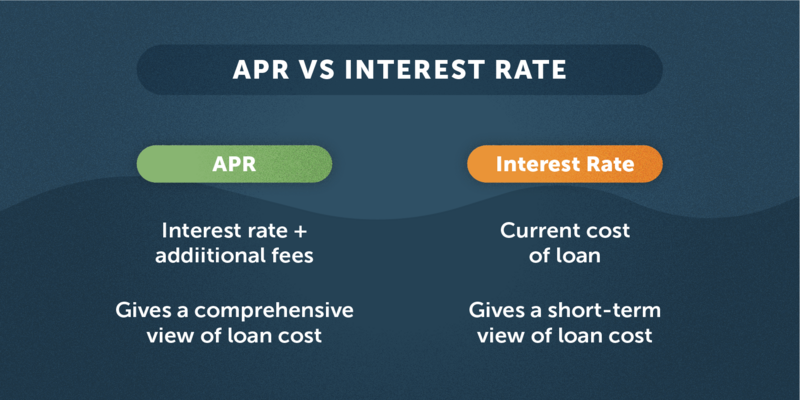

The annual percentage rate (APR) and the interest rate are often used interchangeably when discussing a mortgage's pace, although they are distinct concepts. Total costs, including interest, origination fee, and points, are reflected in the annual percentage rate. For the most accurate comparison between two mortgage offers, the APR will give you a far better sense than the interest rate of how much each would cost altogether. According to Nilay Gandhi, the senior investment adviser of Vanguard Personal Advisor Services in Philadelphia, "the APR helps the borrower analyze the real all-in cost of their mortgage." Since the APR considers more than just the interest rate, it's in your best interest to scrutinize every fee to ensure you're getting the lowest possible rate on your mortgage. The total price you pay for a property over time might be significantly affected by even a slight adjustment in the annual percentage rate.

Understanding these elements is vital when picking the finest mortgage lenders. The interest rate is the cost you incur to borrow money from a financial institution. The APR represents the interest rate plus the expenses you paid directly to the lender, broker, or both: origination charges, discount points, and any additional expenditures. Those costs add to the loan cost, and APR considers them. Therefore, the APR exceeds the interest rate.

Your annual percentage rate (APR) is often tied to general market interest rates. Some lenders may charge you an interest rate that is an index plus a certain percentage (the "margin"). Combine the two figures to obtain your rate. For instance, lenders may state that you must pay their prime rate + 9%. For example, if your credit card's annual percentage rate (APR) is 3.25 percent and the prime rate is 3.25 percent. Your effective annual percentage rate is 12.25%, calculated by adding 3.25% to your initial APR of 9%. A regular daily rate of.034% would result if your card issuer used the standard calendar year of 365 days to determine your charges. Your creditworthiness is a significant factor in determining the interest rate offered by mortgage lenders.

Because you might spend $2,000 to acquire 1 discount point to drop the interest rate by 0.25%, Loan A's interest rate is higher (4.25%), and the costs are lower ($3,000), whereas Loan B's interest rate is lower (4%) and the fees are higher ($5,000). If you look at the chart below, you'll find that Loan B has a lower APR, which means you'll spend less on interest, principal, and fees throughout the loan's 30-year term. A loan's interest rate or an investment's return is expressed as an annual percentage rate (APR). A financial instrument's annual percentage rate (APR) must be made public by financial institutions before a contract is executed. To safeguard customers from deceptive advertising, the APR offers a uniform foundation for providing yearly interest rate information. Lenders have some flexibility in determining the APR. Thus it may need to represent the actual cost of borrowing accurately.