If you are a currency trader, investor, or business owner that deals in international exchange rates, then it is important to understand the difference between forward and spot rates. Both variations of the FX rate determine the value of one currency against another; however, they can display very different values depending on your time frame.

Both the forward rate – which refers to an exchange rate for a future transaction – and the spot rate – referring to an immediate transaction executed at current market rates– play a critical role when hedging against foreign-exchange exposure risk.

In this blog post, we'll discuss what each type of FX rate is used for and some strategies for using them together to ensure maximum benefit from any given financial situation.

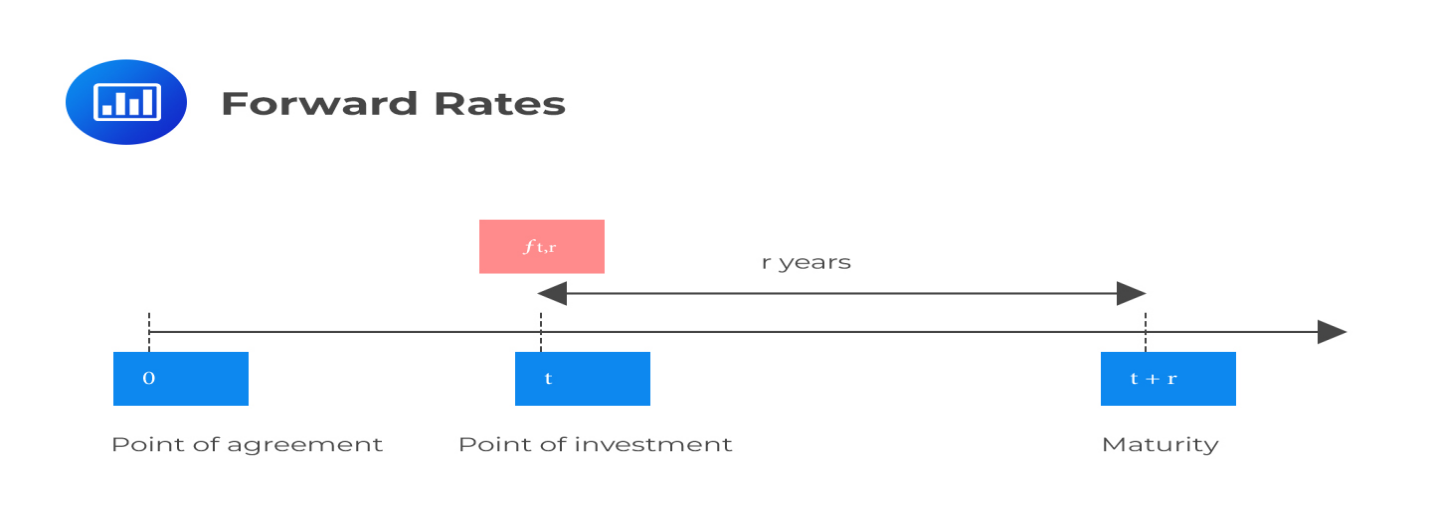

The forward rate is an exchange rate at which two parties agree to transact at some point in the future. This rate is determined and negotiated between both parties involved. It can be established with a standard calculation or adjusted according to specific parameters, such as the delivery date and payment terms.

Generally, this type of agreement allows traders to lock in an exchange rate for some time, providing them with the assurance that their currency will not suffer from fluctuations in the market.

Spot rates are exchange rates between two currencies for immediate transactions at current market prices. Spot rates generally reflect the most up-to-date market trends and provide an accurate view of the current FX market. However, they can be subject to volatility and are constantly in flux.

Compared to the spot rate, forward rates allow traders to hedge against potential foreign exchange losses due to fluctuations in the market. The main difference between the two is that spot rates reflect current market prices, while forward rates are predetermined and negotiated between two parties.

It is important to understand that both forward and spot rate variations are useful in FX hedging strategies and can be used to provide stability against currency exchange risks.

Following are:

1. Spot rate is for immediate and current transactions, whereas the forward exchange rate is for future transactions.

2. Spot rates can change at any point, while forward rates are locked between two parties.

3. Forward rate involves the flexibility to adjust it according to specific parameters, subject to both parties agreement.

4. Spot rates reflect up-to-date market trends and provide an accurate view of the current FX market, while forward rates tend to be more stable as they are prearranged between two parties before executing the transaction.

5. Spot rates are subject to high volatility due to constantly changing market conditions, while forward rates provide traders with assurance against potential foreign exchange losses due to price fluctuations.

6. Spot rates are determined by the current market conditions, while forward rates are predetermined and negotiated between two parties.

7. Spot rate is generally more expensive than a forward rate as it reflects the most up-to-date market prices, while a forward rate may be lower due to the agreement of both parties before execution of the transaction.

8. Spot rates indicate where the FX market is heading regarding future trends. In contrast, forward rates reflect a commitment from both parties involved concerning exchanging currencies at a specific rate in the future.

9. The risk associated with a spot rate is higher than a forward rate as there is no guarantee on how much you may need to pay for the currency exchange in the future due to market volatility.

10. Spot rates are used for day-to-day transactions, while forward rates are more suitable for hedging and long-term investments.

Understanding the difference between spot and forward FX rates is essential when trading currencies or investing in the foreign exchange market.

Following are the pros and cons of using a forward rate versus a spot rate:

1. Provides traders with assurance against fluctuations in exchange rates due to market volatility.

2. Allows flexibility to adjust it according to specific parameters, subject to the agreement of both parties involved.

3. Provides traders with an opportunity to lock in an exchange rate for some time.

4. It Is more suitable for hedging and long-term investments than spot rates which are more suitable for day-to-day transactions.

1. Can involve significantly higher transaction costs than spot rates, depending on the currency pair being traded and the type of contract.

2. Is not flexible and can be difficult to adjust or terminate, even if market conditions change significantly.

1. Reflects current market prices and provides an up-to-date view of the FX market.

2. It Is generally cheaper than a forward rate due to its flexibility in responding to changing market conditions.

3. It Can be used for day-to-day transactions, compared to forward rates, which are more suitable for hedging and long-term investments.

1. Is subject to high levels of volatility due to constantly changing market conditions.

2. It Can be difficult to predict as prices will fluctuate depending on factors such as political instability or natural disasters that can affect exchange rates at any given time.

3. Does not provide traders with assurance against potential foreign exchange losses due to market volatility.

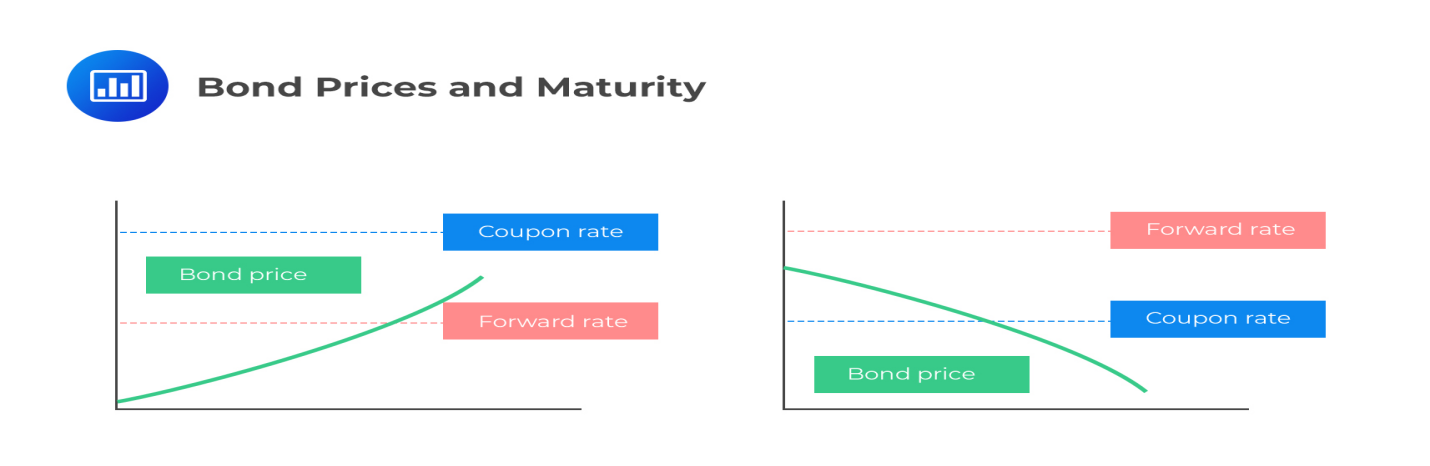

When the forward rate is higher than the spot rate, this indicates that the currency is expected to appreciate during the time frame of your transaction. This type of forward rate will typically lock in a certain exchange rate if you expect your base currency to increase in value by the time of your transaction.

A spot transaction is an immediate exchange of one currency for another, with the current market rate as the benchmark. A forward transaction is when two parties agree to buy and sell a certain currency at a predetermined future date and a pre-agreed rate.

Yes, sometimes the spot rate and forward rate can be equal. This could happen if both parties expect the currency exchange rate to remain stable during your transaction – making a forward contract unnecessary.

An example of a forward rate will be if you agree to purchase 1,000 USD for 895 EUR with the agreed transaction date being in 3 months. The forward rate is determined by market conditions at the time of agreement and will remain fixed until the pre-agreed date.

Understanding the differences between spot and forward FX rates is essential when trading currencies or investing in the foreign exchange market. Spot rates provide an up-to-date view of the current market, while forward rates can provide traders with assurance against potential losses due to market fluctuations. Both have their benefits and drawbacks, so it is important to consider the pros and cons of each before making a decision.